Ah, tax season. Let’s face it: it’s never a fun time, but it’s also necessary. While some might hire a tax professional to take care of the nitty-gritty, if you’re looking to save a few bucks, and your taxes are pretty straightforward, it’s actually pretty easy to do it yourself at home using intuitive tax software.

Ah, tax season. Let’s face it: it’s never a fun time, but it’s also necessary. While some might hire a tax professional to take care of the nitty-gritty, if you’re looking to save a few bucks, and your taxes are pretty straightforward, it’s actually pretty easy to do it yourself at home using intuitive tax software.

Whether you owe money or you’re bound to get a refund, tax software can walk you step-by-step through the process to get to the end result. It can help you maximize everything you can to get the best possible outcome that ensures you don’t leave anything you could be claiming on the table. You can even file your taxes online.

There’s no escaping getting your taxes done. But with careful planning throughout the year, and patience to use the software at home, it can become like second-nature. Once you do it the first time and get the hang of it, the thought of filing each year won’t be as daunting.

Getting ready to tackle your taxes? Here are some tips to ease the pain, the first of which is to grab yourself a strong cup of coffee or tea and a bottle of water before you get started!

Organize tax related information ahead of time

The most important tip for preparing your taxes is that you keep things organized ahead of time, throughout the year. I buy a basic accordion file folder each year where I store receipts, bills, vehicle details, mortgage papers, banking, and credit card statements, etc. in a nice, organized fashion. If you’re a bit more progressive than this old “shoebox” method, you might want to consider investing in accounting software for keeping all of your finances organized, including credit card bills, receipts, major purchases, and invoices, particularly if you run a home-based business. In many cases, these software work with tax filing software so you can automatically import information, further simplifying the process when it comes time to file.

If you’ve done this already, you’re well on your way to a much easier, painless process. If you missed out this year, don’t sweat it. Keep this in mind for next year and start now as you prep for the next tax filing season.

Find out what tax credits are available to you

The second step is to research what tax credits are available to you. These may vary depending on your household income and province. But there are a lot of purchases that you can get a credit on, and could help reduce the amount you owe, or what you get back on an income tax return. For example, did you know that full-time and part-time students can claim up to a certain amount in addition to tuition, and transfer this amount to their parents if their income isn’t high enough to benefit from it? Additionally, students can claim up to a fixed amount of money towards textbook purchases. In some provinces, college or university students can claim a portion of their rent as well.

Tax credits aren’t just for students, though. If you recently bought your first home, for example, there are a number of expenses you can claim, like moving expenses and the Home Buyers’ Amount credit. And don’t forget those important RRSP contributions, which can significantly impact how much tax you owe for a calendar year.

It’s advisable, however, to research online, or check with others on changes within your province.

Don’t forget medical expenses

While you might have insurance through an employer or parent, many of us still have to pay at least a portion out of pocket for certain procedures or prescriptions, like eyeglasses or medication. Maybe your dental plan, for example, covers 80% of the cost, but you need to pay the remaining 20% yourself. For major dental work, that could equate to hundreds, even thousands, of dollars.

While you might have insurance through an employer or parent, many of us still have to pay at least a portion out of pocket for certain procedures or prescriptions, like eyeglasses or medication. Maybe your dental plan, for example, covers 80% of the cost, but you need to pay the remaining 20% yourself. For major dental work, that could equate to hundreds, even thousands, of dollars.

The amount you can claim is based on your income, but anything above what’s covered could count towards a credit. The Canada Revenue Agency website has a dedicated page that lists all eligible medical expenses.

Work with your spouse to determine the best approach

Sometimes it’s best to do your taxes together with a spouse and pool expenses, and other times, it might make more sense to do them on your own. But really, no matter your marital status, every person must file their taxes individually.

That said, if you are married or in a common-law relationship, make sure to divide up the expenses appropriately. For example, deductions like child care and medical expenses should go on the lower income earner’s taxes, while donations should be claimed by the person who makes more money.

If you’re both retired, look into options like pension splitting to maximize your returns.

Leverage a new business

There’s a trend towards the “gig economy,” where people have opted for side jobs here and there versus a traditional 9 to 5 permanent position. Others have decided to start side businesses alongside their main careers, or even in place of them. If you fall into this category, whether you registered a business to sell cupcakes from home or work as a handyman for hire, don’t forget to leverage all of the deductions that apply to you. This can range from your home-based office and everything in it, to your supplies, to even transportation required to visit clients. You shouldn’t start a business because of the tax benefits, but if you have done so, make sure you benefit from the tax deductions that come with being a small business owner or sole proprietorship.

There’s a trend towards the “gig economy,” where people have opted for side jobs here and there versus a traditional 9 to 5 permanent position. Others have decided to start side businesses alongside their main careers, or even in place of them. If you fall into this category, whether you registered a business to sell cupcakes from home or work as a handyman for hire, don’t forget to leverage all of the deductions that apply to you. This can range from your home-based office and everything in it, to your supplies, to even transportation required to visit clients. You shouldn’t start a business because of the tax benefits, but if you have done so, make sure you benefit from the tax deductions that come with being a small business owner or sole proprietorship.

Enlist tax help if needed

While more complex tax filing might require the assistance of a professional, for simple tax returns, the software can do the trick. And most software providers have customer service personnel and/or online wizards and help tools that can provide assistance, answering questions or clarifying things you might not be sure about. Help is usually just a click or phone call away, and the answer is often simple enough that you can solve the issue in mere minutes.

If you’re concerned, you can also commission a second set of eyes to go over everything for you before officially filing, whether it’s a spouse, close friend, business partner, or professional consultant, or tax advisor. But oftentimes, with basic individual tax filings, the software will walk you through everything you need, leaving no stone, or potential source for a refund, unturned.

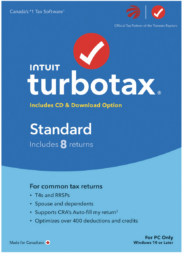

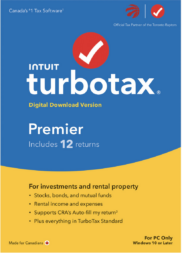

Software options vary. It starts with basic software for filing up to four returns, which is perfect for a couple and their elderly parents, for example, or parents with working kids still living at home. You can move up to software that allows for filing up to eight returns, great for a group of roommates or small businesses, to premier options for up to 20 returns. Opt for online or go old-school with a CD option as well if preferred. If you run a home-based business or your own business outside of the home, there are also tax software options with guidance for filing for your business as well. This software will also include things you need for GST/HST tax filings, for example, if that applies to your business based on where you’re located in Canada. Many options work with both PC and Mac, but make sure to check OS compatibility before purchasing.

Bottom line

Keep in mind that, if your taxes are relatively complicated, you might want to enlist the help of a professional, even if it’s to look over what you’ve inputted in tax software to ensure that there’s nothing missing. In most cases, however, tax software is fairly detailed and can walk you through basic tax filings so you’ll be done in no time. As you fill in the blanks, questions will pop up along with examples and explanations for each section so you won’t miss anything. So pour that big mug of java and get going!

See lots of tax software options to help with your taxes at Best Buy Online.