Your T4 has arrived (or soon will) telling you tax season has arrived. I found years ago that it’s nothing to be feared thanks to the amazing tax software we have available to us. Don’t let tax season raise your blood pressure. Take charge and file online! There are many great reasons why it’s the best way to get your taxes done. You’ll find the right tax software for your needs at Best Buy. And you also have a chance to win software from either TurboTax or Ufile.

Your T4 has arrived (or soon will) telling you tax season has arrived. I found years ago that it’s nothing to be feared thanks to the amazing tax software we have available to us. Don’t let tax season raise your blood pressure. Take charge and file online! There are many great reasons why it’s the best way to get your taxes done. You’ll find the right tax software for your needs at Best Buy. And you also have a chance to win software from either TurboTax or Ufile.

Will you wait until the tax deadline is minutes away to file?

What’s your favourite dessert? We all have one: chocolate cake, spumoni ice cream, sherry trifle? Imagine someone offers you your favourite dessert and says you have only until April 30th to get a serving … after that day, no dessert for you. What would you do? I’d try to get my dessert as soon as I could to not take a chance of missing out. So many things could happen between now and then that might prevent me from arriving for my serving on April 29th, or some other date in the future.

Well hear me out. For most of us, taxes must be filed by April 30th. Actually that isn’t 100% accurate. Self-employed workers can file by June 15th, however, if they owe money they still have to pay before May 1st. Also, according to the CRA website:

But for all intents and purposes, get your taxes done by April 30th. You might ask, “what does that have to do with dessert.” Just like you wouldn’t want to miss out on your favourite dessert, you also don’t want to miss out on the benefits of filing on time … early even.

Filing your taxes early reduces stress and can save you money

Imagine the worst case scenario: you file after May 1st and have to pay late fees. That would be bad. You could have used the money you paid in late fees to buy your favourite dessert. No matter how much you like dessert, money to buy anything you want is better! Now imagine the best case scenario. You file your taxes as soon as you can: February 20th is the first day we can file. Say you get your paperwork all sorted out, enter everything you need into the tax software you purchased from Best Buy (or won from this Best Buy Blog contest!) and learn that if you just put a bit into an RRSP you would actually get money back from the government rather than pay more to the government.

That’s smart. Money you put into an RRSP isn’t going anywhere. It still yours. And you get money back from taxes instead of paying to them. Money in your pocket for dessert in your tummy. The feeling you get by doing this at the end of February is akin, I would argue, to getting a free slice of your favourite cake—and eating it too! However, wait until after March 1st and you miss out. That’s the deadline for contributing to an RRSP to reduce your 2022 taxes. You only get maximum benefits by filing early.

Prepare now, file in February, and be stress free for Spring break

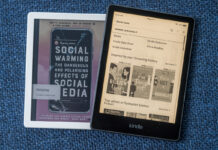

I know I make it sound so easy, and you might feel taxes are anything but easy. I can relate. But it is easier if you break it into little steps. We have a detailed article with some tips to help streamline the process. For now, here are some simple steps. Step 1: choose the right software for your needs. Best Buy has many types and brands. Select the one that resonates with your needs, has the number of returns you need for everyone in your family, and will allow you to claim investments or other additional taxable income or deductions for your needs.

Step 2 is to gather the paperwork you need for all of the returns you are filing so you can get it done without scrambling to find this document or that document. Lastly, Step 3 is to enter the information in the tax software, decide if you should put some money into an RRSP before you file. The second last step is the file your taxes.

What is the last step? Breathe! March arrives and you can breathe. April arrives and you can breathe. May arrives and you can breathe. Others may get stressed out by the emerging Tulips and Crocuses signalling the approaching tax deadline, but not you. You will relax and smell the flowers. Maybe with an ice cream cone or piece of cake.

How to enter

Entering this contest is easy and you can enter in two different ways.

- In a comment below, tell us how you filed last year, did you wait until the last possible moment, AND lastly, what favourite dessert will you treat yourself to once your taxes are done.

- For up to two (2) additional entries, create a public post on a social media channel (one entry per channel!) sharing with your friends and followers that you are entering a Best Buy Blog contest for a chance to win software to help you with preparing your taxes; include the hashtag #BestBuyTaxescontest, so we can find your post, and include the picture at the top of this article. Then return here and tell us in a comment below on which channel you posted it and the name of your channel (since many people use pseudonyms) so that we can check and verify your entry. You can use any social media channel (Twitter, Facebook, Instagram, TikTok, LinkedIn, etc.), but the post must be public so we can verify it is there.

What you can win

At the end of this contest we will randomly select six (6) winners. Each winner will either get one of three TurboTax Premier 2022 (PC) with 12 Returns or one of three UFile 2022 (PC) with 4 Returns.

This contest runs from Feb 1st to Feb 19th.

Remember, you can enter in two different ways. Many people don’t discuss tax season due to the stress many of us feel about it. So tell your family and friends that this article is partly about desserts and they can win a useful prize.

Win Tax Software Rules and Regulations

Good Luck.

I file with Turbo tax last year and many years before, for sure is last minute things. I would love to have a Green tea cheese cake to celebrate my success!

I did my taxes through hr block

I used Turbo online a few weeks after the deadline. I don’t pay taxes, no I am not the 1% I just don’t make enough money. Canned rice pudding with a sprinkle of cinnamon and allspice.

I filed online using tax software and submitted them in mid March. My favourite dessert is English Trifle.

Overpriced accountant, who DID wait till the last minute,, and creme Brule!

We used Turbo Tax & Filed Early. Then a celebration thru the drive thru at Tim Hortons for Coffee & Timbits. Thank You Best Buy.

Last year I used TurboTax to file I love using turbo tax. Much better refund results this way. I submitted my taxes in mid April. I was waiting to be able to get turbo tax at a discount. Never happened so I got it at Costco which was still a much better price than in store. When I finish my taxes I’m going to have a nice red velvet cupcake. Yum!

Turbo tax and vanilla ice cream

i filed with turbo tax early, after i got my t4. i would have some ice cream after

in the past my family has filed our taxes using studiotax in Feb and our favourite is a black forest cake or a chocolate cheesecake to celebrate

I filed using the good old paper method in March last year. I look forward to some apple pie when I complete my taxes this year!

I filed online using tax software and submitted it before the deadline. My favorite dessert is ice cream.

I filed on time with an accountant and my favourite desert to treat myself with is lemon meringue pie.

I filed last year using TurboTax and have for the last 6 years. I procrastinate a little but don’t wait till crunch time. I think my desert of choice after finishing my taxes will be a tall spicy caesar….I’m sure if I put a cherry on top, that will count as desert.

I filed myself using turbo tax, mid March so not first but not last minute! I’ll treat myself to a slice of coconut cream pie when finished!

lets do the taxes today

My Dad completes my return and uses Studio Tax to file on line. It’s completed middle of April! We then treat ourselves to chocolate ice cream as our reward.

I complete my return using Studio Tax to file on line. It’s completed middle of April! Chocolate ice cream is my reward for a job well done!!!

My husband completes my return and uses Studio Tax to file on line. It’s completed middle of April! We then treat ourselves to chocolate ice cream as our reward.

I use Studio Tax and file on line. I complete to tax filing middle of April! Chocolate ice cream is my reward.

My Dad Last Year Used Turbo Tax & Filed Early. the Drive Thru at Tim Hortons For Tim Bits.

I filed early with Turbo Tax. Once this year’s is done, I’ll treat myself to something chocolate.

I used Turbo Tax last year. Once I’m done this year’s taxes, I will treat myself to something chocolate.

My Husband Last Year Used Turbo Tax & Filed Early We will go thru the Drive Thru at Tim Hortons For Coffee & Tim Bits.

I didn’t do my taxes last year, so I definitely need all the help I can get! My dessert of choice is Key Lime Pie

I filed early with Turbo Tax and hopefully will do so again. Celebrate with warm chocolate brownie and vanilla ice cream.

I filed as soon as I could and this year when I’m done I’ll be treating myself with a flapper pie.

Used Turbo Tax last year and was able to have my taxes done early as it is such a easy program to use. Celebrated and enjoyed an Earl Grey bubble tea! 🙂

TurboTax has been our go-to for as long as I can remember! We never leave it to the last min but we do wait long enough to ensure we’re capturing as many tax breaks as we can. I’d treat myself to a hot fudge sundae from Dairy Queen!

I did my taxes early last year. I’ve been using Turbotax for 20 plus years. When I’m done I treat myself to delicious cherry cheesecake. I wish Turbo Tax would reward people somehow that use this software Year after Year.

I did my taxes with Turbotax last year and it went well. I got my refund in early March.

I am going to celebrate this year with Baskin Robbins ice cream.

I usually do my whole families taxes. I love paperwork and could do this for a living. Turbo tax software would make my life a whole lot easier as I usually do it the old fashioned way by hand when I pick up the forms from Canada Post. FIngers crossed that I win.

Used Turbotax and filed on time and it would be a brownie

I used Turbotax and, because I owed a little, waited until the last minute. Creme brule is my go-to dessert.

Hi I filed my taxes on line last year, about two before the deadline. I treated myself to cheese cake.

have been using turbo Tax for the last few years, and think it is OK.

I have filed mine and my family’s returns for years with TurboTax by April 1st. Marble Slab Creamery’s Banana Split would definitely be my dessert choice!

I filled my tax return with HR Block in March last year. I’ll treat myself to Poutine once my taxes are done.

I filled my tax return with Ufile in Feb last year. I’ll treat myself to chocolates once my taxes are done.

I decided to use a new tax return agent this past year than years previous because my previous agent retired. Unfortunately, this new agent bit off more than she could chew and many people like myself were left with late returns without much of an explanation. For years I’ve been telling myself that I would like to gain some independence and do my own taxes, without having to rely on someone else. I think this was the final push I needed, so this year I’m determined to do them myself, winning the software would obviously help but I think I have the motivation to do them early on my own, rewarding myself with some ice-cream and hot chocolate after!

I am a retired Chartered Accountant hence I always file my taxes by filling out forms manually or use the most inexpensive software. I also help my retired friends by filing their taxes for free – that is my way of giving back to the community. I don’t have a sweet tooth hence the smile I see on my friends face is my treat.

I used TurboTax to eFile last year about a month ahead of the deadline. My favourite dessert are mini donuts!

Filed last minute with an accountant through Turbotax Desktop. Favourite dessert; Sugar pie with fresh whipped cream.

Instagram – @mrdprize

Twitter – @mrdprize

I filed online using tax software and submitted well before the deadline. Favourite dessert – a slice of blackforest cake

I filed online a few weeks before the deadline. Once I’m done, I’ll treat myself to some Tiramisu!

I used UFile and it was done the last day of March. I would treat myself to pizza after

i filed my taxes early last year using TurboTax. I’ll have ice cream after!

Posted on Facebook

https://www.facebook.com/nadeem.hajee/posts/pfbid0qtjyKj2bRZZR2DoiFC8DMeiPHZsdaXAhMaYfMr1bF12z7gRzdVXTQrHUsj88cXxDl

Comments are closed.