Are you thinking about buying a new smartphone? With numerous options available—outright purchases, financing, and leasing—it can be overwhelming to choose the best route for your needs. Each option has its pros and cons, making it essential to find what works best for you.

In this article, I’ll explain what financing is, outline the different types available, and provide tips to help you choose the best option for your needs. Plus, I’ll share how you can maximize your savings on a new device by trading in your old one.

What is financing?

Financing allows you to buy a smartphone now and pay for it in monthly installments, typically over two years. Instead of paying the full price upfront, you can manage your budget with smaller, monthly amounts.

Unlike purchasing an unlocked device outright, where you pay the total price upfront, financing lets you spread the cost over a set period. This can make high-end smartphones more accessible, allowing you to choose a device that fits your needs without the burden of a large upfront payment.

Types of financing

Best Buy Canada offers two main types of financing:

Keep it plans

With a Keep it plan, you finance the device over 24 months, and once all payments are complete, the phone is yours to keep. Monthly payments stop as soon as the device is paid off, lowering your bill.

Bring it back plans

Also known as leasing, the Bring it back plan allows you to pay for the use of the phone with the flexibility to decide whether you’d like to keep it at the end of the term. When the plan concludes, you have three options: return the phone, upgrade to a newer model, or pay a residual amount to keep it. This option typically has lower monthly payments, which is perfect if you like to upgrade your phone every couple of years.

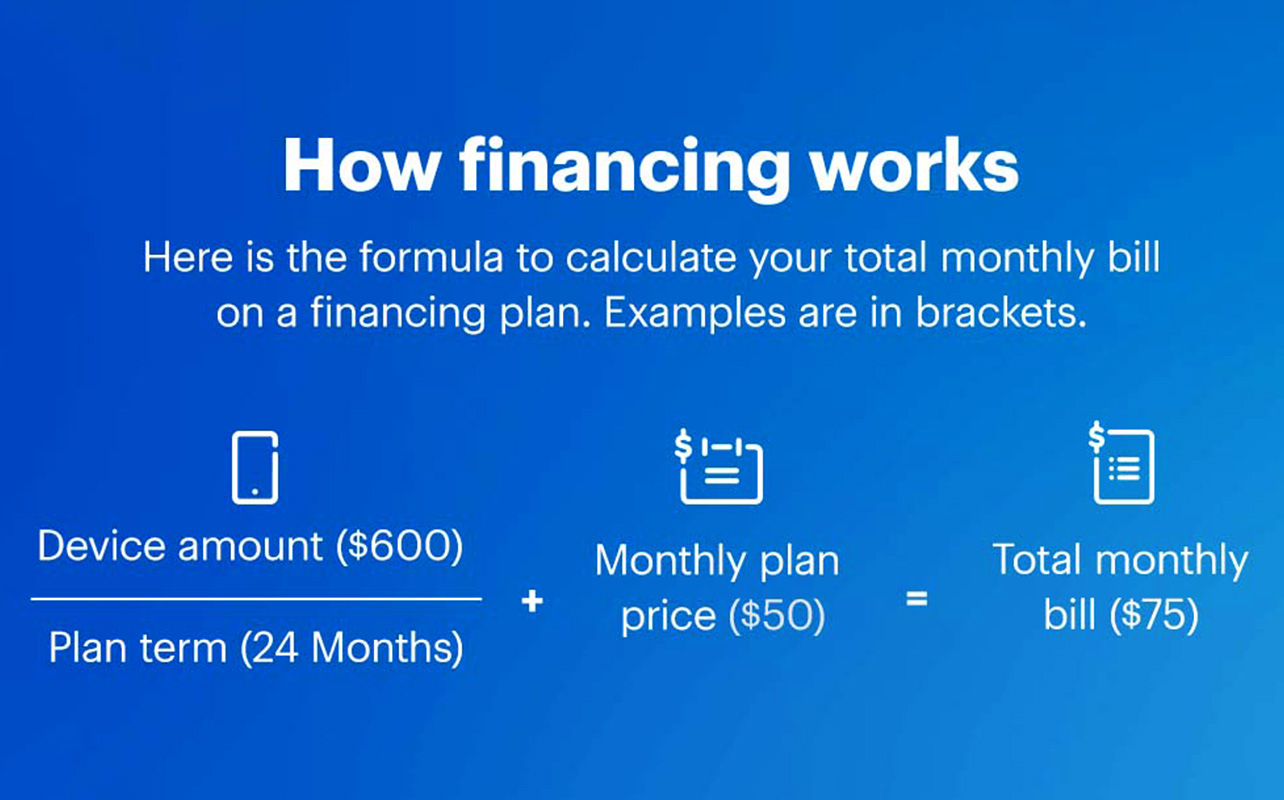

How financing works

There are a few things to keep in mind when it comes to financing:

- Down payments: Whether a down payment is required depends on factors like your credit check and the phone’s price. In some cases, if your credit limit doesn’t cover the full cost or the phone is particularly expensive, carriers may ask for a down payment.

- Monthly payments: Once any required down payment or taxes are paid, the remaining balance is divided into equal monthly installments over 24 months. This amount is typically added to your monthly wireless bill.

- Interest rates: Most financing plans offer 0% interest, meaning you only pay the retail price of the phone.

- Loan term: Financing terms are usually set at 24 months, which is the maximum allowed for phone financing in Canada. After that, you fully own the phone unless you’re on a Bring it back plan, in which case you have the option to upgrade, return, or buy out the device.

How financing affects your phone bill

Your monthly bill will include two separate charges: the cost of your wireless plan and the phone payment. This clear breakdown helps you see exactly what you’re paying for each. While the monthly phone payment stays consistent, be aware of an initial activation fee (usually on the first bill) and any upfront taxes, which may vary by carrier.

Financing also commits you to a specific carrier or retailer for the full 24-month term. If you choose to end the plan early, you may need to pay off the remaining balance in full.

Benefits of financing

- Affordable payments: Financing breaks down the total cost into manageable monthly payments, making it easier to budget for a new phone.

- Immediate access: Financing allows you to get the latest device right away, without needing to pay the full price upfront.

Potential drawbacks

- Commitment: Financing requires sticking to the payment plan for the full term, which could become challenging if your financial situation changes.

- Down payments and credit limits: Depending on the device and your credit profile, a down payment may be required, or your credit limit may only allow for financing one device. However, if you’re financing through a carrier and have credit left over, you may be able to finance additional devices.

- Activation fees: An activation fee may be added to your first bill, making your initial payment higher than the standard monthly amount.

Choosing the right financing option

Here are a few tips to help you make the best choice:

- Budget wisely: Ensure that the monthly payment fits comfortably within your overall expenses.

- Understand the terms: Check if any down payment or tax is due upfront, and be aware of potential fees if you want to end the plan early.

- Think about upgrades: If you like to upgrade your phone regularly, a Bring it back plan could be the best fit. However, if you’d rather keep the phone long-term, a Keep it plan might be a better choice.

Trade in your old device at Best Buy

Best Buy’s Trade-In Program allows you to exchange old devices for a Best Buy gift card, which can help reduce the cost of your new phone. It’s an easy way to recycle responsibly and cut down on e-waste. Here’s how it works:

- Check your device’s value: Use Best Buy’s online tool to check the estimated trade-in value of your device.

- Bring it to a store: Visit a participating Best Buy location with your device.

- Receive a gift card: You’ll get a gift card based on your device’s value, which can be applied to your new purchase or used on other items.

Frequently asked questions

Can I trade in my old phone when financing a new one?

Yes! Best Buy’s Trade-In Program lets you trade in old devices for a gift card, which can reduce the amount you need to finance.

What happens if I miss a payment?

Missed payments can lead to late fees and affect your credit. Be sure to make payments on time.

Can I finance an unlocked phone?

Yes, financing is available for unlocked phones through Best Buy’s partner, Fairstone. All phones in Canada are unlocked by law since 2017, so you can use them with any carrier.

Still have questions about financing?

Whether you choose to finance or buy a device outright, Best Buy’s Blue Shirt advisors are here to help you find the best plan for your needs. Shop online or visit any Best Buy location to get started, and don’t hesitate to ask a Blue Shirt advisor about financing options, promotions, or current deals.

Ready to get started?

Whether you’re looking to finance a smartphone or buy one outright, Best Buy offers flexible options to suit your needs and budget. With helpful tools like the Trade-In Program and guidance from knowledgeable Blue Shirt advisors, the process is simple and straightforward. Explore your financing choices today and take advantage of the latest technology with a plan that works for you. Visit Best Buy Mobile online or in-store to get started!

Table of Contents

Do I need enough money in my bank account for the full price of the phone to do the plan? What if I know I will be receiving money.

Can i avail just for the phone,i have existing plan

Hi, yes you can just buy an unlocked phone, which doesn’t come with any prepaid plan or contract. The link is https://www.bestbuy.ca/en-ca/category/unlocked-phones/743355

This is so much worse than before, it’s so insanely more expensive to get a phone now. Before, you just had to pay a little bit of money upfront and sign up with a plan, and you own a brand new phone with a reasonable monthly plan, and a reasonable promotional price. I paid $160 for my S10 in late 2019 during the boxing day sale, and $50/month 2 year contract for 5gb of data and unlimited everything. That was a steal and now it’s over, I can’t believe they are charging so much, we already have the highest cell phone expenses of any developed country, and I can’t believe they are doing this, it’s totally insane and impossible for low income people to have a phone now.

We have always had Android phone considerING I Ph. Is it hard to get familiar with the switch? And is it more expensive?

Koodo won’t let me get another phone on contract. So what i want to know is if i try financing through best buy but with a Koodo plan will koodo still denie me

You can finance just your phone with the Best Buy card

Can I finance a phone and not have it registered to my carrier. I am on a corporate plan. So I need to pay for it myself. Hopefully financed.

Can I only finance the phone let’s say from Bell and do not register for any cell plans?

iPhone 11pro max I need total monthly charges please

Hi Gurmukh,

You can get pricing details for specific phones and a range of cellular carriers at any Best Buy location.

Best regards,

Martin