Money – you can’t live with it, you can’t live without it, and it’s all too easy to let it slip through your fingers on a day-to-day basis without even knowing where it’s gone off too.

Money – you can’t live with it, you can’t live without it, and it’s all too easy to let it slip through your fingers on a day-to-day basis without even knowing where it’s gone off too.

If you run your own business you probably know that simple accounting keeps everything in order, but I’ve found that one of the biggest challenges I’ve encountered as far as money is concerned is taking care of the household expenses. Maybe it’s spending far too much on my favourite Americano at the coffee bar around the corner, or it works out to groceries taking a huge upswing in price – whatever it is that’s out of control in your household budget, the only way to create change is manage your household expenses every day.

I think it’s a real skill balancing a household budget, and it’s all too easy to slip back into free and easy spending. But if you put a few of these tips into place, you’ll start seeing positive results right away.

Here are three simple tips to manage your household expenses like a pro:

Figure out your goals and set them in stone

What do you consider to be household expenses? For me it’s groceries, utilities, maintenance, mortgage, property taxes, and insurance. I keep my gas and car bills separate, but you could also add in the gas you use every week, childcare and child related costs, or basically anything you consider to be part of your lifestyle.

Once you’ve established your household expenses, what are you shooting for as far as managing your expenses is concerned? If you just want to see where your money is going on a weekly and monthly basis, that’s a great short-term goal. You might also like to save up for a trip, a new house, or just build a nest egg, and that would be considered a long-term goal. Other goals could be saving money on your grocery bill each month or cutting down on your utility bills.

I find it helpful to write these goals down and put them somewhere I’ll see them every day. I’ve gone so far as to put a stickie note on top of my credit card and debit card, reminding me to think before I spend. It’s saved me from more than one impulse buy.

Track your income and expenses

Track your income and expenses

Knowing what you bring home and what you spend is the most important step in managing your household expenses. There are a few ways you could do this, including spreadsheets and receipt scanners.

Spreadsheets are one of the most common ways you can track your expenses, and there are a lot of different free spreadsheet templates available online for managing what you spend. I’ve used Office for Mac for several years to detail what I’ve spent, and I find it easy to use and easy to share if I want to send it to someone else.

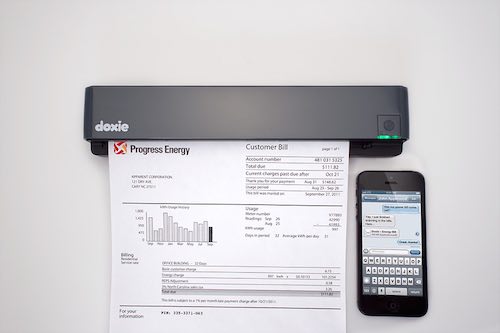

Receipt scanners are another great way of tracking your household expenses. Scanners like Neat Receipts have built in software to take everything you scan and put it in a category. You can use it to track things like taxes and how many times you buy certain things on a monthly basis. Neat Receipts also uses an app to scan receipts the second you get them and they’re stored in a cloud service so others can access them too. Doxie Go is another portable scanner, and I’ve just picked one up to manage my household and business expenses. It works with other apps like Drop Box and Google Drive, so you can save your expense sheets to a cloud drive.

Try to track your expenses for an entire month without skipping a single purchase, then sit down and see exactly where your money is going. That way you can decide what to eliminate if you need to cut down in some areas and where you can find the money to put away.

Stick to the plan

Easier said than done, right? Research has shown it takes approximately 66 days for something to become a habit, and keeping track of your household expenses is a habit that’s well worth forming. If you try to keep up on your expense tracking for at least 2 months straight and you implement changes based on what you find out, you will definitely see a difference in what’s left in your bank account at the end of the month.

Need an example of a simple change you can make after tracking down your expenses? Take something simple like coffee for example – if you go to Starbucks and order an Americano, it will cost you approximately $2.50. If you do it every single day for 7 days straight, it will cost you $17. If you have one every day for a 30-day month, that’s $75 you spent on coffee. Want to save that money? Just invest in a French press and travel mug, and then make your own Americano at home before you leave for the day.

Simple changes equal big savings when you manage your household expenses. If you need motivation to get started, check out Bestbuy.ca’s selection of business and home office supplies. Happy saving!

Image from doughmain.com